- +91 9828449993

-

Asset allocation is like the art of cooking. And just like with cooking, there are numerous elements such as the recipe, the ingredients you're using, and external factors that affect your end product. This blog post will discuss six elements that affect our asset allocation. We will discuss why you should consider these five elements before allocating your assets.

There are different types of assets, and all assets don't move in the same direction. For example, if the equity markets are falling, gold prices typically move up as stock prices and vice versa. It is because stock prices go up when the market is optimistic, and gold prices rise when it is pessimistic.

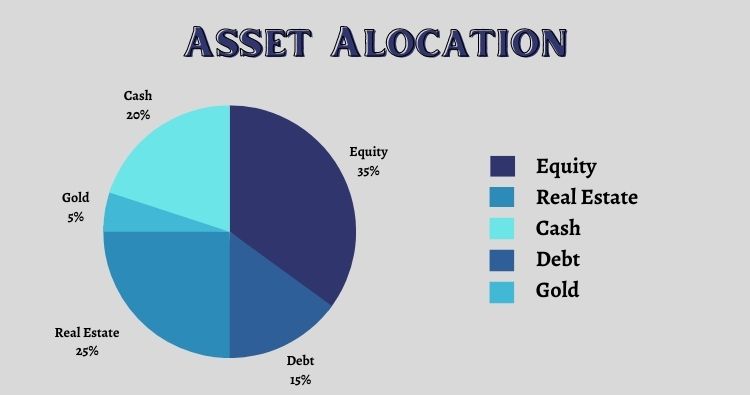

A proper asset allocation is necessary to get optimum returns from your investments. And this is where the concept of asset allocation enters. By investing in different classes of assets in the market, you can take reduce your portfolio risk.

Let's understand some elements that affect asset allocation.

Age is an essential element that affects asset allocation while investing in an instrument. For example, if you are a millennial, which means you are at the age of 20-35, you may have a high-risk tolerance as you have a long life ahead to achieve your long-term goals.

Similarly, if your age is between 35-55, you may have a moderate risk profile to invest in risky products. You may have already achieved your long-term goals and are willing to accomplish a few short-term objectives. And individuals aged more than 55 years may prefer the least riskier investment.

Income is another element that needs to be considered while deciding on asset allocation like job security, employed or unemployed, consistency in cash flow matters. If you are a salaried employee, you can systematically invest in different assets. But if you have a business, you may need to carry out asset allocation in a way that best suits you. If your income status changes, you can revise the asset allocation breakup to suit your current scenario.

Your investment horizon is another feature of your asset allocation. If you are looking forward to investing in a short-term financial goal, you can invest in fixed-income securities like fixed deposits and short term debt funds.

On the contrary, if you are planning to invest in a long-term instrument, you may invest in equities as it has the potential to deliver higher returns over the long term.

The amount of risk you can take with your money also impacts your asset allocation.

Risk-taking capacity can be divided into three parts:

Risk profile depends on your willingness to take the risk for your hard-earned money. Investing in stock markets are subject to market volatility risk. If you cannot bear the short term volatility in the equity markets, you can look at investing in debt instruments.

Liabilities also play an essential role in determining your asset allocation. It is because your liabilities influence your risk-taking capacity and financial goals. For instance, a 25-year old who lives with parents and doesn't have any liabilities may easily invest 90% of the income in equity funds. However, the same may not hold for a person who is the family's sole earning member. They might be more interested in saving money for emergencies or any short-term requirements.

Analyzing these factors can be proven helpful in allocating your assets while investing in different asset classes. We can see that these five factors are related to each other. You can determine the time horizon by deciding on your financial goals, your number of dependents and your age can help you understand your risk profile, and so on. It is essential to evaluate each element that may affect your assets allocation and investment category.

This blog is purely for educational purposes and not to be treated as personal advice. Mutual fund investments are subject to market risks, read all scheme-related documents carefully.

+91 9828449993

+91 9214049993

1st Floor, Block No. 3, Ambay

Market, F-59, opposite Hotel

Solista, Chittorgarh,

Rajasthan 312001

Privacy Policy

Copyright © Invest Karo India. All rights reserved. |

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-129707 | Date of initial registration ARN – 01-Oct-2017 | Current validity of ARN – 30-Sep-2026

Grievance Officer- Kamlesh Somani | ksnext80@gmail.com

Important Links | Disclaimer | Disclosure | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors